The Future is Being Reconnected

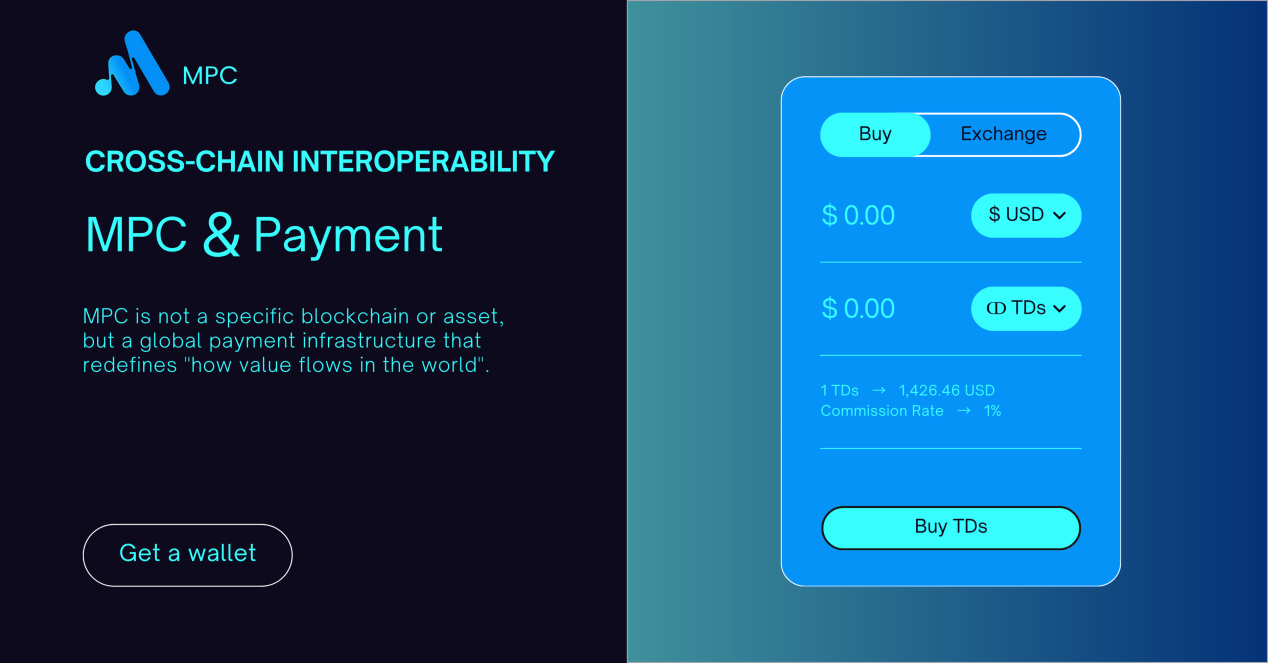

MPC is not a specific blockchain or asset, but a global payment infrastructure that redefines how value flows in the world.

MPC is not a specific blockchain or asset, but a global payment infrastructure that redefines how value flows in the world.

Initiated by the US Betterment Asset Management Foundation, MPC is dedicated to building the next-generation value internet infrastructure for the world.

To enable global value to flow as freely as information, removing barriers to payment caused by borders, institutions, or technological limitations.

MPC aims to build a truly global, instant, low-cost, and compliant payment network through blockchain technology. We believe that future monetary systems should be defined by technology and efficiency, not by geography.

"The world doesn't need more tokens, but infrastructure that truly creates practical value and solves real pain points."

The global cryptocurrency payment application market is experiencing rapid growth, driven by digital asset adoption, mobile payment penetration, and surging cross-border payment demand.

Consumers and merchants globally are increasingly incorporating digital currencies into daily payment options.

Faster throughput, lower gas costs, and enhanced security features are making crypto payments more reliable and convenient.

The global remittance market exceeds $860 billion annually, with SWIFT system suffering from high fees and slow processing times.

Mobile internet penetration is enabling more users to access digital currency and banking services directly through their phones.

2023 Global Market Size

Annual Growth Rate (2024-2032)

Projected Market Size by 2032

Despite having over 400 million crypto users and hundreds of billions in stablecoins, crypto payments have yet to become mainstream. MPC addresses the core issues preventing widespread adoption.

Mainstream blockchains often charge several dollars per transaction during busy periods, making "micro-payments" nearly impossible.

Users face situations where the coffee costs less than the transaction fee – an experience that directly blocks mass adoption.

Optimized high-performance mainnet with transaction costs as low as less than 1 cent.

MetaPay aggregation engine automatically selects the optimal chain and lowest cost path.

Supports batch payments, significantly reducing costs for multiple transactions.

Mainnet supports 2-3 second fast confirmation.

"Instant receipt + on-chain asynchronous settlement" mechanism (similar to Visa's risk control model).

Merchants receive payment success notifications within 2 seconds.

Mainstream blockchain confirmation times range from seconds to minutes.

Users have to "wait for block confirmation" after scanning a QR code in a store – a disastrous experience that merchants cannot afford to risk.

There are dozens of independent blockchains in the market.

Users cannot directly pay with assets they hold.

Payment requires "cross-chain, token exchange, withdrawal" – a complex, costly process with high failure rates.

Users can pay with any mainstream assets like ETH, USDT, SOL, BNB, etc.

MPC's MetaBridge automatically completes exchange and cross-chain operations.

Merchants ultimately receive MPC or stablecoins.

Why MPC can become the next-generation global payment infrastructure

Just cents to complete global payments.采用DPoS high-performance consensus with high throughput and minimal network congestion.

Compared to BTC/ETH, costs are reduced by 99%+.

With instant finality, transaction processing takes only 2-3 seconds.

Irreversible with high security, providing a payment experience as smooth as Apple Pay or Visa.

MetaBridge protocol supports payments with mainstream chain assets including BTC, ETH, USDT, USDC, BNB, SOL, and more.

Users pay with any asset they hold, merchants receive stablecoins or MPC.

MPC mainnet will develop a complete financial ecosystem including DEX, lending protocols, stablecoin system (MUSD), and automatic rate matching mechanisms.

Over 1.7 billion people globally lack bank accounts. MPC provides solutions where users only need a mobile phone to participate in global payments.

MPC implements on-chain tracking technology integrated with third-party audit tools, supports KYT (Know Your Transaction) automatic review, and provides localized compliance APIs.

MPC's architecture is designed around high performance, scalability, low cost, cross-chain interoperability, and security compliance.

DPoS consensus mechanism with high throughput, efficiency, and second-level transaction confirmation.

Supports atomic swaps and flash exchanges with automatic asset conversion and settlement.

Connects merchants, users, and blockchain networks with instant fiat exchange and clearing services.

Provides user interfaces for interacting with the payment network, managing private keys and accounts.

Reduces payment price volatility risks and provides on-chain liquidity and exchange capabilities.

Ensures MPC payment network complies with global regulatory requirements, supporting KYC, AML, KYT, and transaction monitoring.

MPC enables digital currency to be comprehensively implemented in daily life, enterprise operations, financial services, IoT, and emerging industries.

Traditional SWIFT: 3-5 days, $30-$50 fees.

MPC: Minutes to arrive, fees as low as cents.

Ideal for: Labor remittances, international suppliers, cross-border settlements.

Online payments: Users can pay with BTC, ETH, USDT or MPC tokens, with settlements completed in seconds.

Retail POS payments: Merchants can complete收款 through scanning codes or NFC terminals.

Smart contract automatic payments for subscription fees, membership fees, and service fees.

Global salary distribution: Companies can quickly pay salaries to global employees through MPC tokens.

On-chain lending and staking: Users can stake digital assets to obtain loans or yields.

Decentralized exchange (DEX): Enables cross-chain asset trading and optimal rate exchanges.

Electric vehicle charging: Vehicles automatically complete charging fee settlements.

Drone logistics: Automatic payment of service fees after delivery completion.

Global travel payments: Users can pay for flights, hotels, dining with MPC or mainstream crypto assets.

Local merchant payments: Scan codes to complete payments, supporting cross-border payments.

MPC token is designed to build a global payment ecosystem, support DeFi, incentivize developers and community participation.

Ecosystem building, merchant incentives, technology incubation

Long-term incentives for core team

Strategic cooperation, market expansion

User promotion, activity rewards

Market financing, liquidity provision

Risk reserve, future strategy

MPC token serves as the primary transaction medium in the global payment network, supporting online shopping, offline POS, cross-border remittances, and enterprise payments.

Incentivizes users to use the payment system and encourages developers and merchants to join the MPC payment ecosystem.

Staking for yields, lending, liquidity provision, and decentralized exchange trading.

MPC holders can participate in ecosystem governance, voting on ecosystem fund usage, partner project introduction, and technology upgrades.

Listing on exchanges to provide market liquidity, ensuring token price stability and tradability.

Total Supply

210,000,000

Initial Price

1 USDT

MPC's journey to build the next-generation global payment infrastructure

Status: Completed/In Progress

Establishing stable mainnet operation and stablecoin infrastructure.

Status: In Development

MetaBridge supports direct payments with mainstream chain assets.

Status: Planned

Partnering with global licensed payment institutions to support bank card crypto asset purchases and automatic fiat withdrawals.

Status: Planned

Promoting MPC payment entry into e-commerce platforms, retail POS, and cross-border payment industries.

Status: Planned

Forming comprehensive cooperation with multinational enterprises, payment companies, clearing institutions, and fintech platforms.

The MPC project is initiated by the US Betterment Asset Management Foundation, composed of financial technology experts and blockchain developers from around the world.

Founder & CEO

Former Head of Blockchain Research at MIT, with over 15 years of experience in financial technology innovation.

CTO

Blockchain architect with experience at Google and Ethereum Foundation, specializing in high-performance consensus algorithms.

Be part of building a global borderless value internet where money flows as freely as information.